Baby Boomer Featured Articles

-

ADVERTISING

ADVERTISINGBaby Boomers are STILL the Largest Consumer Group in America

-

BABY BOOMERS

BABY BOOMERSBaby Boomers Have 10,000 Days to Change the World [Book/Video]

-

BABY BOOMERS

BABY BOOMERSBoomerang Kids Can Jeopardize Baby Boomers’ Retirement Plans [VIDEO]

-

BABY BOOMERS

BABY BOOMERSThe Influence of the Baby Boomer Generation

-

BABY BOOMERS

BABY BOOMERSTHE ROCK STAR CHRONICLES Interviewing The Legends by Ray Shasho [BOOK]

-

BABY BOOMERS

BABY BOOMERSBaby Boomer Generation is Financially Optimistic

-

BABY BOOMERS

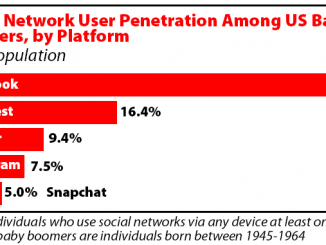

BABY BOOMERSSocial Networking for Baby Boomers by Dotsie Bregel

-

BABY BOOMERS

BABY BOOMERSBoomers Getting Married Again Need to Discuss Finances Before the Wedding

-

BABY BOOMERS

BABY BOOMERSBaby Boomers Want to do it ‘Our Way’ [VIDEO]

-

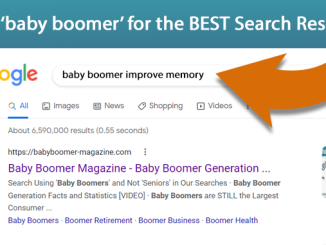

ADVERTISING

ADVERTISINGSearch Using ‘Baby Boomers’ and Not ‘Seniors’ in Our Searches

BOOMER RETIREMENT

BABY BOOMERS

Boomerang Kids Can Jeopardize Baby Boomers’ Retirement Plans [VIDEO]

Boomerang Kids Jeopardize Baby Boomers’ Retirement Plans [VIDEO] Boomerang Kids are pre-adult adults who left […]

BOOMER BUSINESS

BOOMER BUSINESSES

Baby Boomer Women are Savvy Investors – Ready to Retire?

Baby Boomer Women are Savvy Investors – Ready to Retire? […]

BABY BOOMER SURVEYS & POLLS

-

Boomer Surveys-Questionnaires-Polls

Boomer Surveys-Questionnaires-PollsPOLITICAL – SURVEYS-QUESTIONNAIRES-POLLS

-

Boomer Surveys-Questionnaires-Polls

Boomer Surveys-Questionnaires-PollsSurveys/Polls – POLITICAL

-

BABY BOOMERS

BABY BOOMERSSurveys/Polls – Economic

-

BOOMER RETIREMENT

BOOMER RETIREMENTSurveys-Questionnaires-Polls – Retirement Locations