Baby Boomer Featured Articles

-

BABY BOOMERS

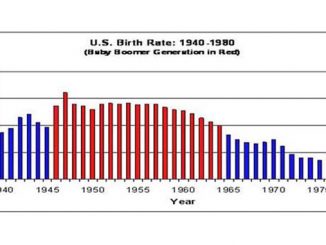

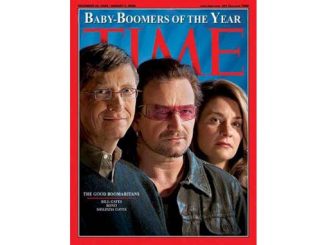

BABY BOOMERSThe Influence of the Baby Boomer Generation

-

BABY BOOMERS

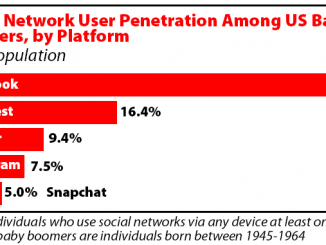

BABY BOOMERSSocial Networking for Baby Boomers by Dotsie Bregel

-

BABY BOOMERS

BABY BOOMERSBaby Boomers Exercise to Improve Memory and Decrease Memory Loss [VIDEO]

-

BABY BOOMERS

BABY BOOMERSWho Are Baby Boomers? [VIDEO]

-

BABY BOOMERS

BABY BOOMERSBaby Boomers Experience Definitely Does Count!

-

BABY BOOMERS

BABY BOOMERSBaby Boomer Generation is Financially Optimistic

-

BABY BOOMERS

BABY BOOMERSSOCIAL SECURITY WARNS BABY BOOMERS OF A NEW SPOOFING SCAM [VIDEO]

-

BABY BOOMERS

BABY BOOMERSBaby Boomers Find Activity Friends Using Dating Websites [VIDEO]

-

BABY BOOMERS

BABY BOOMERSEMPLOYEE RETENTION TAX CREDIT PROGRAM FOR SMALL BUSINESSES

-

BABY BOOMERS

BABY BOOMERSTHE ROCK STAR CHRONICLES Interviewing The Legends by Ray Shasho [BOOK]

BOOMER RETIREMENT

BOOMER RETIREMENT

Boomers Getting Married Again Need to Discuss Finances Before the Wedding

Boomers Getting Married Again Need to Discuss Finances Before the Wedding Article By: Wendy Murphy […]

BOOMER BUSINESS

BOOMER BUSINESSES

Baby Boomer Women are Savvy Investors – Ready to Retire?

Baby Boomer Women are Savvy Investors – Ready to Retire? […]

BABY BOOMER SURVEYS & POLLS

-

BABY BOOMERS

BABY BOOMERSSurveys/Polls – Economic

-

BOOMER RETIREMENT

BOOMER RETIREMENTSurveys-Questionnaires-Polls – Retirement Locations

-

Boomer Surveys-Questionnaires-Polls

Boomer Surveys-Questionnaires-PollsSurveys/Polls – POLITICAL

-

Boomer Surveys-Questionnaires-Polls

Boomer Surveys-Questionnaires-PollsPOLITICAL – SURVEYS-QUESTIONNAIRES-POLLS